Morning Miners!

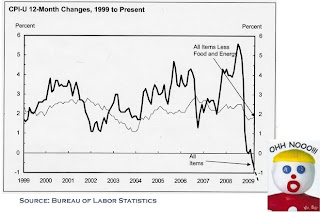

It is 6:14 AM and it looks like we got a good'un outside today! Before we get back to work, let's drill a few more core samples on the latest inflation data. Yesterday we learned the Consumer Price Index (CPI) data rose 0.1% in May from April but fell 1.3% compared to one year ago. If you look at the broken line to the left of Mr. T-Bill, you can see where we are and where we've come since 1999. The big drop off is the largest annual decline in almost 60 years. So what?

The dark CPI line is the "unadjusted" number that is used by the government to gauge inflation and "real" interest rates. The lighter line is the CPI less food and energy for those of you that don't eat or drive. The latter is used to gauge how well the Fed is doing in trying to rein in their team of wild economic horses. Less food and energy, it is fairly stable at 2% and everybody gets a pat on the back at the Federal Reserve.

The rest of us live with the unadjusted number. The good news is that at these depressed levels, inflation is not a problem in the near term. If you have money socked away at the Nevada State Bank in a Certificate of Deposit (CD), it is not slowly vanishing into thin air. A real interest rate or inflation-adjusted return of 2% is fine for preserving (if not making) capital and that's not hard to achieve even with today's low yield CDs (for number geeks, see note 1)

The tougher question is what will happen in six months to a year from now given the government's propensity to print money and run up debt. The prevailing fear is a possibility of Jimmy Carter-style double-digit inflation. This has brought a lot of folks into the gold market including the ole Colonel. Back in April, the Report looked at who holds the gold in the world: Who's Got the Gold. Amazingly, more people now hold gold in the Exchange Traded Fund GLD than all the gold in Switzerland and roughly the same amount as China (after this April article we learned that China has been squirreling away more gold than anyone thought, Lower Propane Bills and More Gold in China). There is a brief CNBC video on GLD near bottom of this blog.

I remain a gold bull but a word of caution is in order. Although gold is the traditional inflation hedge, the Colonel gets a little nervous when everybody starts doing the same thing. A "crowded trade" begets bubbles and we are now too familiar with their fate after living through 2008. Other large holders such as the International Monetary Fund (IMF) may also start dumping gold to raise more money for strapped developing nations.

The bottom line is to take it slow, gold is an excellent way to diversify but may see some wild swings as we move further down the bumpy road to recovery. There is also the slim chance that the government gets this right; the economy rebounds, future inflation is only moderate and the "new" General Motors introduces a car as cool as the turquoise '57 Chevy.

Enough smokin', let's walk the walk:

Oil is up $0.21 to $71.24 in early trading (July contract); Gold is up $4.6 to $940.6 (August contract); Silver is up $0.020 at $14.300 (July contract); Copper is down 0.0045 to $2.2550(July contract); Molybdenum holds steady at $10.58.

The DOW is up 58.57 points to 8555.75; the S&P 500, up 6.18 points to 916.89. The miners are up:

Barrick (ABX) $33.97 up 1.74%

Newmont (NEM) $42.39 up 0.98%

General Moly (Eureka Moly, LLC) (GMO) $2.36 up 0.43%

Freeport McMoran (FCX) $50.67 up o.38% (a bellwether mining stock spanning gold, copper & molybdenum)

Steel stocks are down (a "tell" for General Moly):

Nucor (NUE) $46.72 up 0.73% - domestic steel manufacturing

ArcelorMittal (MT) $32.30 up 1.54% - global steel producer

POSCO (PKX) $82.50 up 0.57%- South Korean integrated steel producer

The Eureka Miner's Grubstake Portfolio is back in the black, up 0.37% to $1,009,597.19.

Cheers,

Colonel Possum

Note 1: As an example of nominal (CD yield) versus real returns let's say you bought a $5,000 CD with a 3.7% coupon last May. It matured last month and the bank returned to you 1.037 x $5000 = $5,185. The year-to-year unadjusted inflation for May is reported to be -1.3% so the "real" return on your money is:

"real" return = ((1 +.037)/(1-.013) - 1) x 100% = 5.06%

Let's now say inflation is flat from here but you could only find a CD with a 1% coupon last month. In a year from now, your real return is equal to the new CD rate since the year-to-year change is assumed to be zero. If you reinvested all of your money, the bank now returns 1.01 X $5185 = $5236.85. Over two years your annualized "real" return is 2.3%, still comfortably above the 2% recommendation. Sleep tight friends.

.png)

.jpg)

.jpg)

No comments:

Post a Comment