Morning Miners!

It is 5:57 AM, the coffee is hot and it's a short week for some as the Fourth heads our way. Last month there was a lot of excitement in the credit markets. This is akin to saying loud rock music was heard coming from the nunnery. Credit or bond markets are usually the shy retiring sister to their flamboyant sibling, the stock markets. Lately, the action has been in the former stirred up by periodic government auctions of Treasurys to raise money for our ailing economy. This affects practically everything from the price of gold to consumer credit; notably mortgage and credit card rates, new car loans and CD yields at your bank.

The Report promised in the blog,

Where's The Duke When We Need Him?, to report key interest rates so you can track where we're going as time marches on. Here are last month's numbers compared to today's national averages (WSJ Market Data, 6/29/09):

10-yr Treasury Note 3.70% vs 3.47%, down

Money Market 1.33% vs 1.29%, down

5-year Bank CD 2.73% vs 2.65%, down

30-yr mortgage, fixed 5.09% vs 5.68%, up

15-yr mortgage, fixed 4.71% vs 5.04%, up

New-car loan, 48-month 7.48% vs 7.30%, down

Home-equity LOC, $30K 5.79% vs 5.81%, up

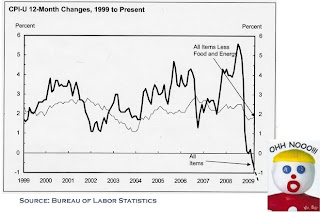

Ohh Nooo Mr. T-Bill !!! If you're saving money, you're making less and if you're fixin' to buy a home you'll pay more than a month ago. The only good news for the consumer are car loan rates which have dropped slightly. This makes some sense since the government really wants you to buy a new car now that they own two of the three U.S. automakers. The ole Colonel is not even going to talk about credit card rates which presently live in a house of mirrors reflecting bank desires to raise them and confusing legislation to protect the consumer.

Is the government plan for the credit markets working? This is what the Report said last month:

"...the 10-year note is key in setting mortgage and other consumer credit interest rates which the government has been working like the dickens to keep contained. The Fed has gone beyond cutting rates to directly purchasing such financial assets such as mortgage-backed securities, as well as printing new money to buy Treasury notes for the first time in half a century. Yikes! All of this effort is to reflate housing and get us back on track economically." (Eureka Miner's Market Report, 5/28/09)

OK, the 10-year T-Note rate is now lower but mortgage rates are moving higher. Am I missing something here? We'll watchdog these rates at the end of every month until Gentle Ben and Tiny Tim show up at our party with champagne. The Colonel actually wishes them the best, I'd love to see all of this magically work at the end of the day (or year or years or decade?).

Now a little catch up on two other news items that could impact Eurekans:

BEIJING -- China will push reform of the international currency system to make it more diversified and reasonable, and to reduce excessive reliance on the current reserve currencies, the People's Bank of China said Friday. (WSJ, 6/27/09)

Last week this was the idea of Li Lianzhong who heads the economic department of the Party's policy research office. Now it looks like an official party line. Remember this effort will no doubt cause China to increase their considerable gold reserves which supports higher gold prices (i.e. less supply and more demand from the world's largest gold producer, China - bingo!).

By the by, here is a link to a ranking of buyers and sellers of gold from fellow blogger, NSE 955 . I can't attest to its accuracy but it appears to be good and fairly recent data:

World's top 10 buyers & producers of goldThe last item is a big step for Newmont:

DENVER, June 25, 2009 -- Newmont Mining Corporation (NYSE: NEM) is pleased to announce that it has successfully completed the acquisition of the remaining 33.33% interest in the Boddington project from AngloGold Ashanti Australia Limited, a wholly-owned subsidiary of AngloGold Ashanti Ltd. Newmont now owns 100% of the Boddington project, which is the largest gold project in Australia.

The BIG news coming at us this week will be the June employment report, which will be announced earlier than usual on Thursday. The U.S. markets will be closed Friday for the Independence Day holiday.

Enough talk, let's walk the walk:

Oil is up $1.70 to $70.86 in early trading (August contract); Gold is down $5.3 to $935.7 (August contract); Silver is down 0.272 to $13.890 (September contract); Copper is down 2.95 to $2.3385 (September contract); Molybdenum is steady-eddy at $10.58.

The DOW is up 76.78 points to 8515.17; the S&P 500, up 5.88 points to 924.78. The miners are mixed:

Barrick (ABX) $35.05 up 0.06%

Newmont (NEM) $42.43 down 0.16%

General Moly (Eureka Moly, LLC) (GMO) $2.50 down 3.85%

Freeport McMoran (FCX) $50.67 up 0.24% (a bellwether mining stock spanning gold, copper & molybdenum)

Steel stocks are up (a "tell" for General Moly):

Nucor (NUE) $45.55 up 0.89% - domestic steel manufacturing

ArcelorMittal (MT) $33.64 up 0.99% - global steel producer

POSCO (PKX) $83.50 up 1.51%- South Korean integrated steel producer

The

Eureka Miner's Grubstake Portfolio is down 0.06% to $1,016,544.65.

Cheers,

Colonel Possum

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)